Revolutionize Your Auto

Insurance Underwriting Process

with the Power of Machine Learning

How Can Underwriters Achieve Exponentially Better Results?

Soteris has harnessed the power of machine learning and focused it on a single point of failure in the typical auto insurance risk selection process to deliver exponentially better results than would otherwise ever be possible.

With our SaaS platform, you can turn on all segments and accurately select and quote only the adequately rated risks on an individual policy basis at point of sale.

With Soteris, you can finally grow your business while also driving down your loss ratio.

Why is Soteris a Game Changer for Auto Insurance Underwriting?

With Soteris, your processes are driven by policy-level intelligence that is significantly more precise than predictions informed by third-party data collection.

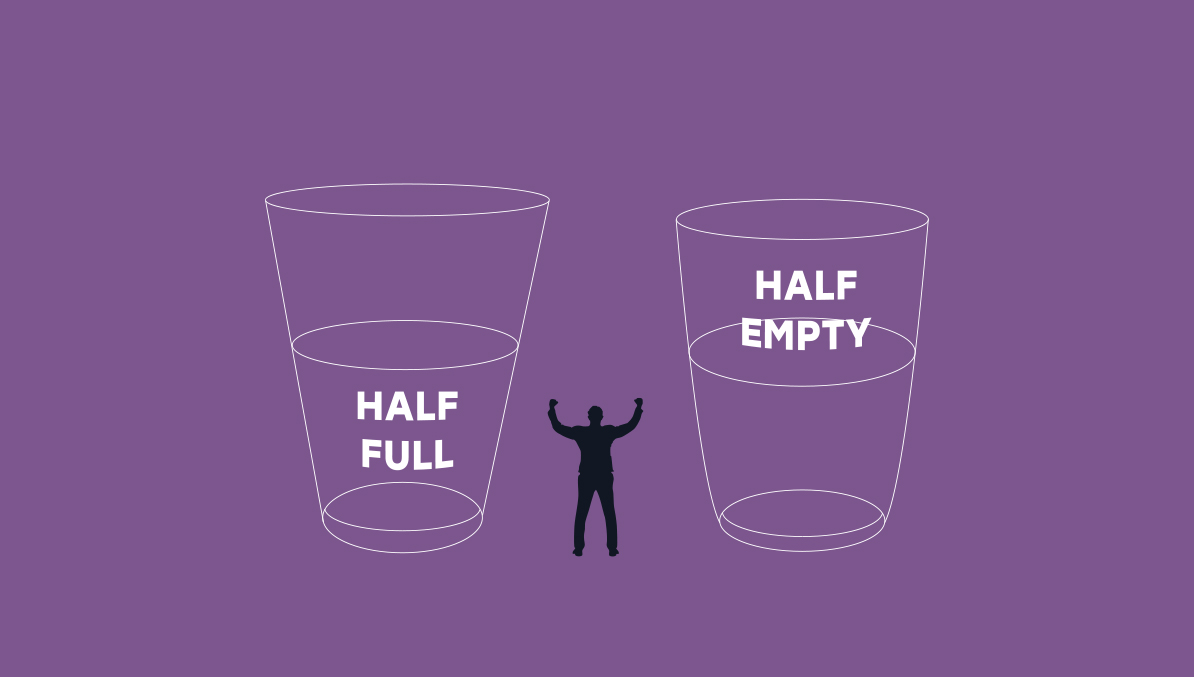

Until now, insurers have turned off entire segments of their book in the quest for better profitability.

Unfortunately, that approach eliminates both inadequately-rated and adequately-rated risks within the segment, greatly reducing premium volume. With Soteris, you can leave all segments on, and precisely and efficiently select policies in less than one second.

Up to two thirds of the policies in

poorly-performing segments are actually

good risks.

It’s Time to Modernize Outdated Underwriting Processes

Over the past decade, the risk landscape has changed. Ten years of poor underwriting profitability are delivering

a loud wake-up call – old risk selection methods aren’t working.

To achieve different results, auto insurers must deploy new strategies. Soteris offers a proven solution.

- Access the dedicated data science and machine learning resources that only large insurers could afford in the past.

- Generate ratemaking data based on your own book’s loss experience.

- Predictively score each policy in less than one second, at the rate call of your choice, or at multiple rate calls.

- Quote only adequately-rated risks, driving down the loss ratio of your existing book, with all segments turned on.

- Use Soteris intelligence to precisely adjust rates and identify “sweet spots” to more effectively capture future market share.

Seize the Opportunity to Dramatically Improve Profitability

The Soteris machine learning underwriting solution can be

implemented in just four months, alongside your existing systems,

and with your existing rate filings.

Our SaaS model is accessible and affordable for insurers of all sizes.

4 MONTHS

Typical implementation timeframe

Recent Articles

How Can Auto Insurers Secure Better Reinsurance Rates and Terms?

Reinsurance helps auto insurers safeguard their bottom lines, but reinsurers have their own profits to think about, and right now, they are cautious. To stand

When Auto Insurance Rates Fall, How Will You Maintain Rate Adequacy?

Auto insurance rates have been going up for a while, but rising rates can’t last forever. When competitors lower their rates, you will feel pressure

How Consumer Perception of AI Has Evolved

ChatGPT has changed everything. Although it’s not the only AI tool, it did kick off a generative AI explosion as various companies raced to leverage