Auto Insurance Risk Selection FOMO

Have you ever suffered from the Fear of Missing Out (FOMO)? You’ve probably heard of this common condition, often experienced by social media scrollers who start to believe they’re missing out on all the fabulous dinner parties, exotic vacations and fun.

What you might not know is that FOMO happens in insurance too.

If you’ve ever worried that you’re missing out on profitable business that other insurers are enjoying, you’ve experienced FOMO … and your auto insurance risk selection process could be to blame.

Your FOMO May Be Justified

If you’re experiencing FOMO, there’s good news and bad news.

The bad news is that your FOMO may be entirely justified. That’s right – you really might be missing out on great business, and other insurance companies really might be enjoying this business and using it to grow their profits. In fact, Fitch Ratings says some auto insurance companies have returned to underwriting profitability after a period of industry-wide poor results, but other companies are still posting underwriting losses. Smaller carriers may be more likely to experience underwriting losses.

The good news is that this is a problem you can address – and you don’t have to be a large insurance company to improve your loss ratio. By selecting rate-adequate risks – including those in troubled segments – you can start enjoying the improved underwriting profitability that some other insurers are already seeing.

How Turning Off Segments Causes Insurers to Miss Out

If you never checked your text messages or social feeds, you could miss out on some great invitations. Sure, some messages may be unwanted spam, but turning off your phone means you’ll never get the good messages either.

The same can be said about turning off entire segments of auto insurance underwriting. Even within challenging segments, there are many drivers who are rate-adequate risks that could become profitable business for your company. In fact, we estimate that, in many segments, up to 70% of the risks are actually rate adequate.

Let’s say you receive 1,000 applications in a challenging segment. Up to 700 of those applications could be adequately rated. If you turn off the segment, you exclude the 300 inadequately-rated risks (great!), but you also miss out on 700 adequately-rated risks that could have helped grow your business and increase your profits (FOMO!).

The key lies in cherry picking the 700 from the 1,000. A policy-by-policy risk selection process enables you to accomplish this. While old-school, segment-based underwriting lumps risks into big buckets, causing you to throw out well-priced opportunities with the underpriced, policy-by-policy risk selection looks at each risk on an individualized basis, helping you identify more profitable policies overall.

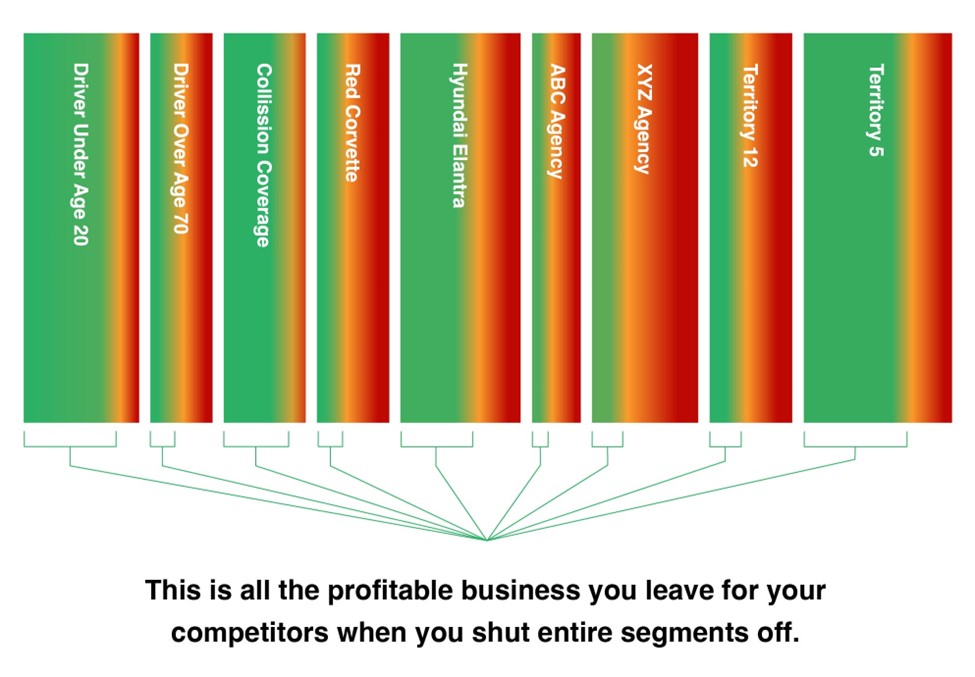

In the diagram below:

- Each rectangle is a business segment that the auto insurer turns on or off for underwriting purposes.

- Segments may be based on any number of characteristics, including driver, vehicle, location or distribution channel characteristics.

- Each of the segments contains many different policies, all of which are color coded on a spectrum based on their potential rate adequacy. In this case, green policies would be rate adequate (profitable based on filed rates for the segment), red policies would be inadequately priced (unprofitable) and orange are somewhere in between.

- We’ve seen as many as 70% of the policies in an overall rate-inadequate segment be rate adequate.

The rate adequacy scoring process occurs on each individual policy, in less than one second. When applications meet the risk score threshold for rate adequacy, they pass straight through. If they don’t meet the threshold, your team can take a closer look. The result is a fast and streamlined auto insurance risk selection process that means you never have to worry about missing out on good business.

The Cure for Your FOMO

If you’re afraid of missing out on auto insurance growth opportunities, Soteris has the cure. Our unique risk scoring process enables you to keep all segments turned on while identifying the rate-adequate risks on a policy-by-policy basis. As a result, you never miss out on the opportunity to accelerate profitable growth.