Are You A Competitor or A Spectator?

Sometimes a wait-and-see approach makes sense. Deciding whether to leverage new technologies is not one of those times.

Progressive’s use of emerging AI tools is a prime example of progress that pays off. In an interview with Barron’s, Cathy Seifert, vice president at CFRA Research, described Progressive’s AI capabilities as “ahead of the curve.”

According to Carrier Management, Progressive achieved a combined ratio of 86.1 in the first quarter of 2024, which was nearly 10 points better than its profit target. Premiums across all lines increased by $2.9 billion to reach $19.0 billion, with personal auto written premiums increasing by 20% to reach $14.5 billion.

The Gulf Between Leaders and Laggards Is Growing

While companies that dare to embrace change and leverage technology race ahead, companies that take a wait-and-see approach fall further behind. Eventually, the gulf between leaders and laggards will grow so large that catching up may seem virtually impossible – and that day may arrive sooner than some insurance leaders expect.

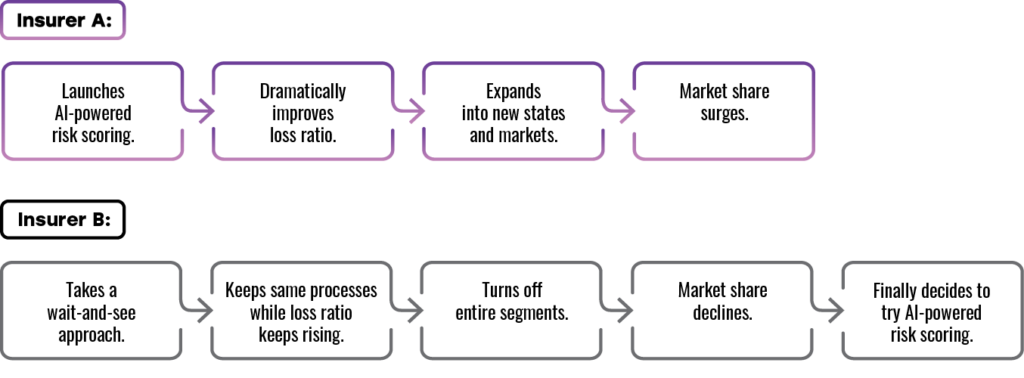

Consider the trajectory of two hypothetical companies, Insurer A and Insurer B. In 2024, both Insurer A and Insurer B sell personal auto insurance regionally, with market share in a handful of states.

Insurer B is finally ready to stop sitting by the sidelines, but Insurer A is now light years ahead, as are many other competitors. Embracing AI no longer offers an edge because all the successful insurers are already moving on to the next emerging solution. It’s unclear if Insurer B will ever catch up.

What About the Need for Caution?

Insurance leaders who take a wait-and-see approach to technology typically do so because they are concerned about risks and pitfalls. They want to observe how things play out before jumping into the action.

It’s true that all the wrinkles have not yet been ironed out when it comes to using AI in insurance processes. However, the only thing that waiting for perfection will guarantee is that you’ll be behind all of your competitors. Caution is smart, but it should be a guide, not a barrier, to progress.

The Time for Waiting Is Over

Sidelines are for spectators. For insurance leaders who want to reap the rewards of technological progress, it’s time to compete.

According to McKinsey & Company, insurance companies that lead in the digital landscape and AI see a five-year growth of total shareholder returns that is up to six times greater than companies that lag in these areas. In the coming years, this difference will likely increase.

Are You Ready to Stop Sitting on the Sidelines?

Soteris enables insurers to leverage innovative risk scoring technology, with little risk. The solution is affordable, can be implemented in just four months, provides immediate feedback, and has levers that you can instantly adjust in house. Why wait another day?