How Can Auto Insurers Secure Better Reinsurance Rates and Terms?

Reinsurance helps auto insurers safeguard their bottom lines, but reinsurers have their own profits to think about, and right now, they are cautious. To stand out and secure the best reinsurance terms, auto insurers need to highlight innovative and effective risk selection practices – methods that can hold up to evolving market conditions.

The Critical Role of Reinsurance in Long-Term Profitability

Careful underwriting practices can help insurers manage their loss ratios and avoid insolvency – but underwriting alone can only go so far.

CARFAX says that as many as 138,000 cars were flooded in Hurricane Helene. Drivers with comprehensive auto insurance coverage will be able to file claims, which is good for them, but possibly overwhelming for carriers with numerous affected policies.

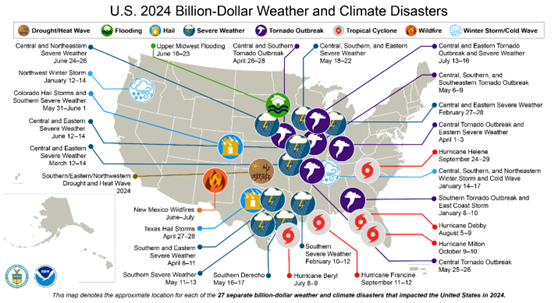

Unfortunately, disasters like this are becoming more common. NOAA tracks U.S. weather and climate disasters with at least $1 billion in losses (adjusted for inflation), and over the decades, the trends have been stark. In the 1980s, there were only 3.3 $1 billion disasters per year. By the 2010s, the number of $1 billion disasters had risen to 13.1 per year. In 2023, there were 28 $1 billion disasters – a new record – and in 2024, there were 27.

Many of these disasters don’t just destroy buildings and disrupt business. They also destroy vehicles. When losses exceed expectations, insurers often have to rely on reinsurance to transfer risk. However, the rise in widespread disasters is also hitting reinsurers hard.

Reinsurers Are Taking Steps to Control Losses

Fitch Ratings reports that reinsurers have been pushing for double-digit U.S. casualty rate increases in 2025. In addition, coverage limits and terms could be restricted. This follows the mid-2024 renewals, which also saw double-digit rate increases of up to 15% for loss-affected accounts and 10% for no-loss accounts. Reinsurers have been reducing their exposures and asking for more granular information to improve risk selection.

These steps may be necessary for the financial health of reinsurers. According to another Fitch Ratings report, insured property catastrophe losses were around $140 billion in 2024. Although losses of more than $100 billion have occurred in the past – in 2005 and again in 2011 – they used to be outliers. Since 2020, they have become the norm.

It’s far too early to predict 2025 losses, but the year is already off to a devastating start with wildfires in the Los Angeles area. CoreLogic estimates insured losses could be as high as $45 billion.

Giving Reinsurers What They Want

Like reinsurers, insurers have struggled with high losses and poor underwriting performance. While market conditions are improving, auto insurers are not completely out of the woods yet. Loss severity is still a serious threat, and rising reinsurance rates could cut into gains insurers are just beginning to see.

What can insurers do?

There’s really only one thing they can do – give reinsurers what they want. As Fitch Ratings explained, reinsurers are seeking more granular information to improve their selection. Insurers need to provide this granular information while presenting themselves as innovative risk managers.

Enter Machine Learning

We’ve covered what insurers need to do. Now it’s time to look at how to do it.

Soteris holds the key.

With the power of Soteris machine learning, auto insurers can accurately predict which risks are adequately rated at the policy level. For insurers, it’s a way to bolster loss ratios without having to turn off segments, but there’s another benefit. Reinsurers also want innovative auto insurance risk selection processes, and they are looking for granular information. If insurers leverage technology to improve their own financial stability, they’ll also make themselves more attractive to reinsurers in the process.

With Soteris by your side, you can:

- Access the dedicated data science and engineering resources that only large insurers could afford in the past.

- Generate rate-making data based on your own book’s loss experience.

- Predictively score each policy in less than one second, at the rate call of your choice, or at multiple rate calls.

- Straight-through process only adequately-rated risks, growing profitable premium volume with all segments turned on.

- Use Soteris intelligence to precisely adjust rates and identify “sweet spots” to capture future market share more effectively.

Soteris Can Help

Securing the best reinsurance rates and terms is a key element of auto insurers’ long-term financial stability. Soteris can help.