The Shift from Gatekeeping to Growth in the Auto Insurance Sector

There’s finally a light at the end of the tunnel for the auto insurance sector. After years spent trying to regain profitability, many insurers are well-positioned to shift into growth mode. That said, controlled acceleration will be key for maintaining acceptable loss ratio targets.

The Long Road to Profitability

In 2022, the U.S. personal auto insurance segment recorded a combined ratio of 112.2, according to AM Best, which represented a deterioration of approximately 11 percentage points compared to 2021. In the first half of 2023, profitability continued to worsen.

It’s been a challenging time for the auto insurance sector, but the tide has started to turn, with insurers beginning to see better combined ratios. Fitch Ratings says U.S. personal auto insurance underwriting results should continue to improve in 2024.

The Insurance Information Institute warns that it will take time before underwriting profitability translates into flattening premium rates. In other words, drivers may continue to see rising auto insurance premiums for a while.

Market Share May Be Redistributed

It’s important to note that underwriting profitability improvements are not happening across the board. Fitch Ratings says some auto insurers have already regained underwriting profitability but others may continue to see underwriting losses through 2024.

As we continue, insurers will fall into three camps:

- Those with continued underwriting losses. These insurers may pull out of segments and shed market share.

- Those who achieve better underwriting performance by raising rates. Further rate increases may cause rate-adequate risks to leave, impacting customer retention.

- Those who experience underwriting profitability and growth. These insurers will be well-positioned to capture market share while drivers shop in search of better options.

How to Grow Premiums While Controlling Your Loss Ratio

While you’ve been focused on gatekeeping, you’ve probably turned off underwriting for several segments. However, even within challenging segments, there are many drivers who are rate-adequate risks that could become profitable business for your company. In fact, we estimate that, in many segments, up to 70% of the risks are actually rate adequate.

You can capture those rate adequate risks buy turning all segments on and applying policy-by-policy risk selection.

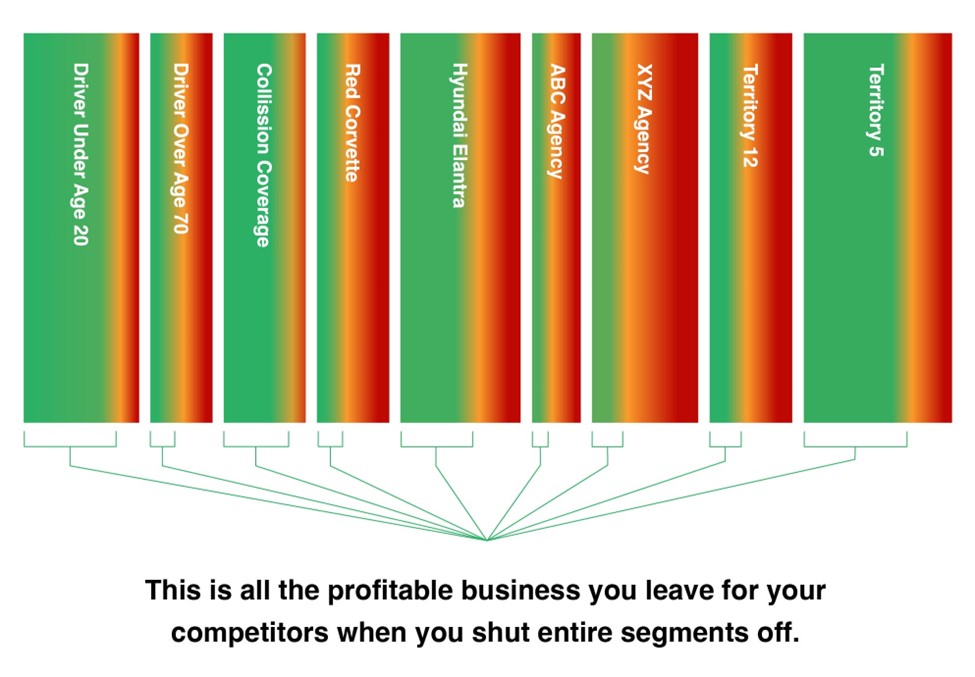

In the diagram below:

- Each rectangle is a business segment that the auto insurer turns on or off for underwriting purposes.

- Segments may be based on any number of characteristics, including driver, vehicle, location or distribution channel characteristics.

- Each of the segments contains many different policies, all of which are color coded on a spectrum based on their potential rate adequacy. In this case, green policies would be rate adequate (profitable based on filed rates for the segment), red policies would be inadequately priced (unprofitable) and orange are somewhere in between.

- We’ve seen as many as 70% of the policies in an overall rate-inadequate segment be rate adequate.

The rate adequacy scoring process occurs on each individual policy, in less than one second. When applications meet the risk score threshold for rate adequacy, they pass straight through. If they don’t meet the threshold, your team can take a closer look. The result is a fast and streamlined auto insurance risk selection process that means you never have to worry about missing out on good business.

Three Mistakes to Avoid

The shift from gatekeeping to growth is exciting, but it’s important to learn from the past. To maintain profitability while achieving growth, avoid these mistakes:

- Using a broad brush. Underwriters often divide risks into segments based on common underwriting criteria, but this method doesn’t account for the nuances between the different risk profiles of individual drivers. Within every segment, an insurer’s rate is adequate for some policyholders and inadequate for others. When you treat all drivers in an entire segment the same, and especially if you turn that segment off, you miss out on a lot of potentially-profitable business. Conversely, if you take a personalized risk selection approach, on a policy-by-policy basis, you can cherry pick the rate-adequate business that is often overlooked by other “broad brush” insurers.

- Being too slow. The internet has made it easy for drivers to receive multiple quotes. In many cases, the first insurer to provide a reasonable quote will win the account. Modern consumers expect instant results. Insurers that are too slow to respond to applications may lose out on business. Ideally, you should receive a rate adequacy score for an individual policy in less than one second, so you can bind rate-adequate risks immediately.

- Resisting change. Traditionally, the insurance industry has been slow to embrace change. Thanks to the rise of insurtech and the potential created by machine learning, more insurers are using modern solutions. However, some insurers may still take a wait-and-see approach to new technologies while their competitors pass them by.

Are You Ready to Shift Into Growth Mode?

For a long time now, auto insurers have been focused on controlling losses, which has often required drastic gatekeeping measures. Now, profitability is improving, drivers are shopping, and policy-level risk selection is available. This adds up to an unprecedented opportunity to accelerate growth.

With Soteris risk scoring, auto insurers can use policy-level intelligence to select rate-adequate risks in less than one second, while leaving all segments on. Learn more and download the case study.